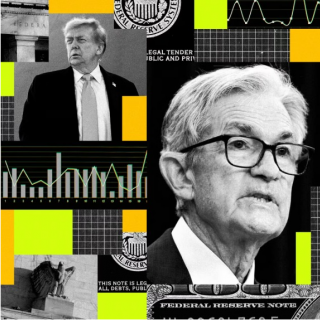

The U.S. Federal Reserve holds its latest policy meeting this week with a historic challenge to its leadership pending in the courts and a rushed effort underway to confirm President Donald Trump's nominee to fill an open seat on the central bank's Board of Governors.

The Fed is confronting a potentially intense pace of change between Trump's attempted firing of Governor Lisa Cook and the Senate's move to approve his nominee for a separate open seat. The move against Cook is both a first-of-its-kind test of the Fed's independence but also potentially disruptive to how the central bank is perceived on global markets.

In an institution known for staid and technocratic debate over complex issues, it's currently not even clear who will be present and voting during the September 16-17 policy meeting.

"It's going to be a pretty big sea change for the Fed, which has always sort of kept a healthy distance from politics," said LH Meyer's Derek Tang, with people potentially coming to view Fed governors through the lens of who appointed them, rather than as people expected to make impartial judgments based on economic data. "I think that's getting harder and harder."

APPEALS COURT DECISION LOOMS OVER FED MEETING

The events of the next two days - with a pivotal appeals court ruling on Cook's status expected as soon as Sunday and a Senate vote set for Monday on Trump's Fed board nominee Stephen Miran - likely won't change the outcome of the meeting. Policymakers are expected to cut the benchmark interest rate by a quarter-percentage-point from the current level of between 4.25% and 4.50% the first rate cut since December 2024.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

But it could begin in a significant way to put Trump's stamp on the central bank, reshaping the Fed's standing in the eyes of the public and its peer institutions, and influencing policy and other decisions.

By Tuesday, when the Fed's rate-setting Federal Open Market Committee convenes, a central tenet of its independence may have been stripped away by federal judges, and Miran, a harsh critic of the Fed currently serving as chair of Trump's Council of Economic Advisers, may have been sworn in as a governor and participating in the debate.

The status quo could also remain largely intact if Miran's nomination hits any last-minute delays or a federal appeals court rules that Cook can remain in office pending a full resolution of Trump's attempt to fire her.

The substance of whether Trump has adequate "cause" to remove Cook over alleged false statements made in a mortgage application before she joined the Fed is likely headed to the Supreme Court. But in the meantime U.S. District Judge Jia Cobb concluded the president was unlikely to prevail in firing her and that Cook could stay in office until the matter is resolved.

Trump asked the federal appeals court to let the firing proceed while the matter is litigated, and a three-judge panel could rule as soon as Sunday on whether Cook will be allowed to continue at her job at least for now.

The Fed has said it would abide by any court decision.

Source: Investing.com

Stephen Miran, a Federal Reserve governor whose term ends at the end of January, said Thursday that he is looking for 150 basis points of interest-rate cuts this year to boost the U.S. labor market. ...

Federal Reserve Vice Chair for Supervision Michelle Bowman outlined significant changes to bank supervision and regulation during a speech at the California Bankers Association Bank Presidents Seminar...

Further changes to the Federal Reserve's short-term interest rate will need to be "finely tuned" to incoming data given the risks to both the U.S. central bank's employment and inflation goals, Richmo...

Richmond Federal Reserve Bank President Tom Barkin said the monetary policy outlook remains in a fragile balance given the conflicting pressures of rising unemployment and persistently high inflation....

The US Federal Reserve agreed to cut interest rates at its December meeting only after a highly nuanced debate about the current risks facing the US economy, according to minutes from the two-day meet...

Oil prices stabilized on Thursday (February 12th), as the market reassigned a risk premium to US-Iran tensions despite US inventory data showing swelling domestic supplies. This movement confirms one thing: geopolitical headlines are still more...

Gold prices weakened slightly on Thursday (February 12th), as more solid US employment data reduced market confidence in an imminent Federal Reserve interest rate cut. The strong employment data prompted market participants to shift expectations of...

The Hang Seng Index reversed its downward trend in Hong Kong on Thursday (February 12th), weakening by around 0.9% to around 27,000 after a strong session earlier. This decline halted the momentum of the short term rally, as investors began to...